Here are some things I think I am thinking about this weekend.

1) Financial Nihilism.

Kyla Scanlon wrote a very good piece in the WSJ this weekend about “financial nihilism” and how young people seem to be turning to gambling and get rich quick schemes. The basic thinking is that the economy no longer serves young people well so they are being forced to turn to these schemes with the hope of making ends meet. This meshes well with what I wrote about last week in the “paradox of the expectations demand curve“. There’s just a lot of pressure on people to keep up these days. But I don’t think this is the only factor and perhaps not even the most important factor. The simple fact of the matter is that it’s just a lot easier to gamble these days and you could make an argument that its prevalence is becoming a very big problem.

When I was 20 years old I had all the same urges that young people have these days. I graduated from college and wanted to get rich quick so I could move to the beach and drink margaritas for the rest of my life. But back then it was really hard to gamble. Really hard. If I wanted to gamble on sports I had to use a bookie or fly to Vegas. And if I wanted to day trade I had to pay egregious commissions on almost any platform that made it punitive to have a gambling mentality. But today there are millions of apps that you can gamble on. And worse, you can gamble on almost anything these days. It’s crazy. And I think it’s actually a terrible thing.

At the same time, I struggle with policy around gambling. From the most basic perspective it’s just outright socially destructive because it’s a zero sum game that is highly addictive. Playing blackjack is nothing like buying stocks, which are a positive sum game in the long-run. The entire structure of the world of gambling is designed for you to lose and make you addicted to losing. And the only reason they make it a game is so you’ll be fooled into thinking it’s enjoyable. I used to think gambling was fun. But now that I am a grumpy old man I think it’s actually terrible. I am militantly against it now. But from a policy perspective I also believe that people should have the ability to choose to do things, even if they’re bad for you. We should be allowed to choose to eat garbage food, drink alcohol, do dangerous things and engage in zero sum games. And while I think it’s good for us to have these freedoms I also think people should speak up about it because if you gamble long enough it will ruin you financially and mentally. [insert old man screaming at cloud meme].

In short, do not gamble. It’s just bad financial management.

2) Temporal Sequence of Returns Risk.

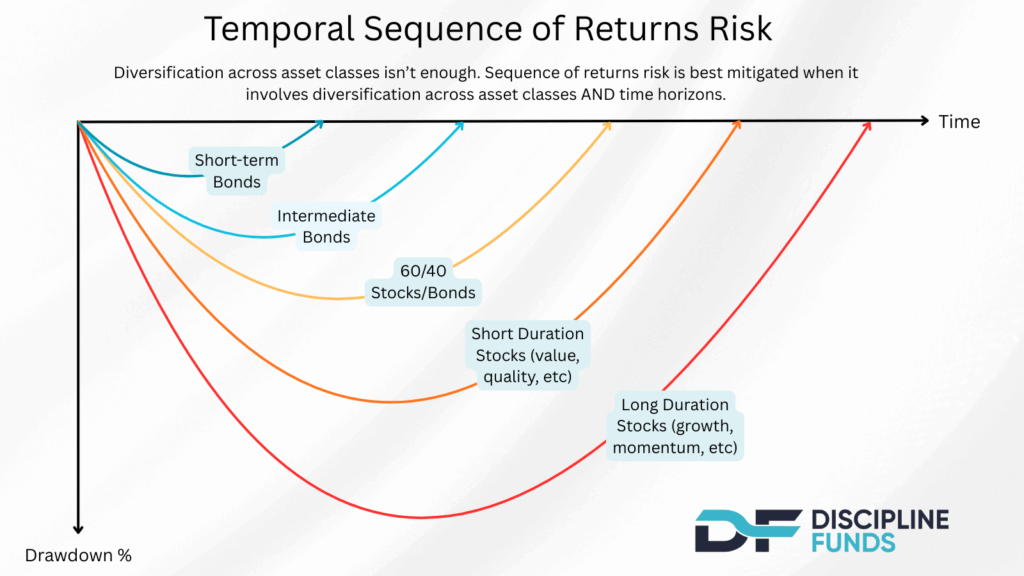

One of the main goals of Defined Duration Investing is to create an asset-liability matching strategy where you specifically match the assets in your portfolio across different time horizons. You aren’t just diversifying across assets, you’re diversifying across specific time horizons within those assets. The reason this is valuable is because it reduces sequence of returns risks, which is the main risk every investor worries most about. No one wants to invest money and experience a large downturn that forces them to alter their portfolio or living standards. And what Defined Duration does is help people diversify across different time horizons so they reduce their sequence risk.

I made this pretty picture to try to communicate this concept. The basic thinking is that different instruments expose you to different sequence risk across time. For instance, stocks typically expose you to higher sequence risk than bonds. But you can get very granular with this concept where you can structure a portfolio where you know that something like T-Bills have almost no sequence risk versus something like intermediate bonds, which have moderate sequence risk. But then the stock market also has sequence risk inside of itself. Growth stocks, for instance, will typically have higher sequence risk than something like low volatility stocks or value stocks. So, when you build a diversified portfolio you want to make sure you’re diversified across instruments with different sequence risk exposure.

This is helpful because we typically talk about sequence of returns risk in the scope of an entire portfolio. So you might put together a portfolio that looks like 60/40 and then say “this portfolio exposes you to modest sequence of returns risk and has a 90% success rate based on 1,000 monte carlo simulations, blah, blah, blah“. But this doesn’t actually communicate what the investor wants to know, which is WHEN and WHERE is my sequence risk? If a 60/40 index fund exposes you to potential 30% drawdowns and 5+ years of real negative returns then that’s not super reassuring even if you have a 90% success rate in the long-term. Yeah, you have a diversified portfolio, but you still have high sequence risk. Telling people to “just stick with it” during a bear market is not a good enough answer. They want to know “can I still pay for my daughter’s wedding in 2 years with this portfolio and what part of the portfolio is helping me achieve that?” They want to understand how the pieces in the portfolio are protecting them across different time horizons to help them meet specific goals. This is why I think asset-liability matching is the future of good financial planning – because it solves the exact questions real people want to know.

3) CPI comes in very, very cool.

The biggest data point of the week was the CPI report, which came in way below expectations at 2.7% versus forecasts of 3.1%. But then when people looked under the hood they noticed that the BLS just left shelter at 0% for October because they didn’t get a reliable read on it. And some people threw a fit over that. But as I’ve been writing for over a year now, shelter is the linchpin in the whole inflation debate. And real-time shelter readings have been negative for years while the BLS figure notoriously lags and has remained positive for the last few years. 0% was actually a generous read compared to real-time metrics. But even if you exclude shelter in the latest reading CPI was still just 2.5%. So it was even lower without the shelter reading!

Anyhow, I think investors should probably look thru the latest CPI report and all the data surrounding the shutdown. It’s thin and unreliable. But inflation really isn’t a problem at present and hasn’t been for a long time. And in order for it to become a problem you’d need a massive offset in other items because shelter is just way too important. And with shelter lagging so much we’re still looking at another 12+ months of weak shelter readings in CPI reports. So, even with commodity prices surging year over year you still need something gigantic to push inflation up a lot when shelter is so weak….

There’s another important point in all of this – secular inflation is very likely to continue to be low in the coming decade in large part because of shelter. To highlight this consider how different this period is from something like the 1970s. In the 1970s shelter CPI averaged 8%. The thing is, shelter is very highly correlated with wages because wages are so closely tied to affordability of rents and housing. And the problem is, we have low and falling wages right now and very expensive shelter. So do we really think shelter is going to surge in price in the coming years? I sure don’t. In fact, I don’t see many strong bullish arguments for residential real estate these days. The Covid price boom pulled years of price appreciation into the present and I think we’re going to spend many more years digesting that price appreciation. And that’s important from a secular inflation perspective because it’s a gigantic headwind to inflation in the future. Add in an unprecedented tech boom and terrible demographics and I find it very hard to make a case for super high inflation unless the government starts running the printing press super fast again. And that seems unlikely because everyone now realizes that the Covid money printing was a big mistake.

Well, that’s all I have for now. I hope you’re all enjoying the holiday season. I personally love this time of year because I get to use Santa as a threat against my children. Nothing will get the attention of a 3 year old faster than mentioning coal in a stocking. So, I guess the lesson is that some of us need fictional characters to instill discipline. And that’s a good thing, because I am a big fan of discipline no matter how it comes. Have a great weekend.