Here are some things I think I am thinking about this week.

1) Chart of the Month and my favorite thing.

I must be feeling generous because this is actually Two things for one thing.

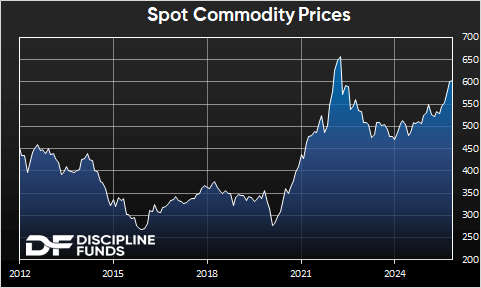

First, here’s my chart of the month. It’s the Bloomberg Commodity Spot Price Index. We’re looking at a 20% year over year change now. That is not what the Fed wants to be seeing. It’s definitely not what Fed Chairman Trump wants to be seeing. Excuse me. I mean Chairman Hassett. Or Powell. Who is in control now anyhow? I have no idea. But whoever it is this isn’t what they want to be seeing as it implies there’s much stronger demand for cost inputs than we would typically see with a 2% inflation target.

My leading inflation index isn’t showing any serious signs of flare up just yet, but this will be worth keeping an eye on. Commodities can be very volatile in the near-term but the more persistent this becomes the more likely it is to bleed into end user costs which will continue to result in sticky upward inflation.

And then here’s my favorite thing I read this week. It was a piece from Alliance Bernstein discussing the “dystopian symbiosis” of Capitalism and Passive Investing. It’s a fictional back and forth between three characters discussing the pros and cons of passive investing, equity market concentration and Capitalism. It’s very balanced even though it has an explicit conclusion (hint: deviate from market cap).

Now, I sort of loathe “passive investing” commentaries because I don’t even think passive investing is a thing. Every “passive” index is a deviation from the global market portfolio that actively distinguishes some arbitrary criteria for holding a group of stocks. The S&P 500 isn’t passive at all. It’s an explicit set of rules determined by a committee of people that actively selects 500 large companies in the USA. It’s “passive” in that it doesn’t involve a lot of discretionary turnover, but it’s still a discretionary process of stock selection. So the whole hating on passive indexing trend strikes me as a bit of a strawman from the start because you’re just bashing a thing (passive investing) which is not really a thing.

Anyhow, sorry for that detour. I get very excited when I get to explain mundane nuances about financial mechanics. The real point of the piece is that there’s evolving risks in the way these instruments can become allocated at times. In this particular environment I think it’s fair to say that US stocks are riskier than they are on average because of the concentration risk. Does that mean you should bail on them? No. Does it mean you might have to be more patient with them than you usually are? Yes. In other words, when concentration risk is high and valuations are high I think that means sequence of returns risk is potentially worse because 10 year+ expected future returns correlate so strongly with valuations. So, if you’re someone who is leveraged to the gills in AI stocks and you’re planning your retirement in 5 years, well, may God have mercy on your financial planner (especially if it’s you).

Anyhow, go have a read. It’s a fun one.

2) Strategic Dollar Reserves!

Here’s an interesting development in the world of crypto. Strategy (aka Microstrategy) announced they’re building up a strategic dollar reserve fund to meet required cash outflows. Yes, that’s Microstrategy, the firm that turned a nice business intelligence software company into a Bitcoin holding company by aggressively buying up Bitcoin in various ways over the last 5 years. And it’s worked out pretty well in fact. Since they first started buying Bitcoin the stock has returned 64% per year while the S&P 500 has done 15.5%. Not bad. Of course, it’s all a bet on “number go up”, but when the number has mostly gone up over that period you have to just tip your cap.

The thing I find most interesting in this news though is that we’re seeing King Dollar reassert itself as the dominant liquidity instrument. Michael Saylor doesn’t want to hold Dollars. But he has to own a strategic reserve of Dollars because they’re the dominant liquidity instrument in the global economy. You can try to shun using Dollars as much as you want, but when its the apex instrument in the system you can’t avoid it because it’s the thing most users demand in payment. Which is interesting in the context of Bitcoin use cases because it’s still nowhere close to supplanting the Dollar.

Anyhow, this continues to be one of the most interesting experiments in modern finance. And while it’s been a favorable trade for the last 5 years the stock is now down -60% from its all-time high. I know I am just a boring “disciplined” investor, but from an asset-liability matching perspective it’s wild to see a firm taking cash and investing it into the longest duration instrument that probably exists with almost no inbetweeners. I can barely wrap my head around the level of risk involved in it, but it’s sure interesting to watch from the sidelines.

3) Goldman Sachs buys Innovator ETFs.

Goldman Sachs bought Innovator ETFs this week for a whopping $2 billion. That’s 7% of AUM, which is kind of a crazy number since most ETF firms are only worth about 2-3% of AUM. I spoke to some people involved in the transaction and they told me that Goldman was not just interested in the explosion in the “defined outcome” space, but they can benefit from the way Innovator’s ETFs require huge amounts of options trading. So there are synergies there that are unique to these types of instruments and the firms involved.

Innovator has always been an interesting firm to me because of the way they structure these defined outcome funds. Cliff Asness did the Lord’s work critiquing these strategies already so I won’t rehash his arguments, but Goldman obviously didn’t agree with Cliff. For the uninitiated, these funds are “buffer” funds. They basically own stocks and then constrain the outcomes using options in some way. In doing so they can cap the potential downside and the potential upside. They typically include high fees and you could argue that the constraints result in huge opportunity costs over time. But they define the time horizon of things. Sounds a little familiar to what some guy is building with a defined duration strategy using low cost index funds, huh? Well, kind of. A Defined Duration strategy doesn’t have explicitly defined outcomes. And that’s the kicker with their ETFs. People love guarantees across time.

My first job out of college was selling annuities and insurance. When I ran the math against the probable outcomes of low cost diversified indexing strategies I could not fathom why anyone was buying the annuities we were selling. So I didn’t last at that job very long. But my basic thinking was this – would you prefer a liquid portfolio with an 80-85% chance of earning 4-6% a year, but with some risk of earning less, or a product that guarantees about 2-3% a year with little flexibility and no chance of higher returns? That’s the basic trade-off of 60/40 stocks/bonds vs a variable annuity. And the buffer funds are basically the same thing. Except you could argue they solve some of the problems that annuities present (like liquidity, surrender fees, etc). And I totally get it. A lot of people want absolute guarantees. And that’s great. Sleeping well is priceless, which is why annuities are still a thing. But also – guarantees are expensive. Why do you think whole life insurance costs so much more than term life? It’s the same thing as above – you get a better guarantee with the whole life and you pay thru the nose for it. People love guarantees across time horizons.

Then again, I would aggressively argue that when you combine a T-Bill/TIPS ladder with structured index funds across time that you actually create even greater certainty than 80-85%. To me, this is the real no-brainer process through which to implement certainty across time, but I am not the one selling an ETF shop for $2B so what the hell do I know?

Housekeeping – I got a ton of good feedback this week about our tool suite and HourglassFP. Thanks to everyone who reached out. We made a few small upgrades in the basic version of the software so the Portfolio Builder output shows your potential stock/bond/cash allocation. The Pro version already did this, but the basic version was confusing some users because it only showed the temporal weightings by bucket, but some of the different buckets are designed to hold stocks as well as bonds. For example, a 5 year Defined Duration bucket isn’t just bonds. It’s a blend of stocks with mostly bonds that averages out to a 5 year defined duration. That’s really the whole differentiator with this process. We are very explicitly quantifying the duration of stocks and then using them as blended instruments with a temporal target so they can be utilized inside of a broader laddering strategy. This way you aren’t confined to just holding bonds in your ladder and can instead enhance the return profiles by holding multi-asset instruments which replace things like 5-10 year bonds. Hopefully that’s a little clearer now that users can see both the temporal weighting AND the more traditional asset allocation weighting in the basic version.

I also added some notes in the explainers to help clarify this. Adding equities into a quantified asset-liability matching process is a totally new thing so I know it’s probably a bit confusing when you first come across it so I apologize if I haven’t communicated all the concepts as clearly as I understand them.

Anyhow, please keep sending me any feedback about any of this. It’s very helpful.

I hope you all have a wonderful weekend. As always, stay disciplined.