Here are some things I think I am thinking about.

1) Data Dump Incoming.

We’re getting back to normal on the data front as the government reopens and we begin getting fresh data again. Thursday will be especially interesting when we get a slew of data including the long delayed September labor report.

I’ve been tracking real-time FICA withholding during the shutdown and things are slowing, but not collapsing. FICA withholding is an imperfect read on the labor market, but it’s about as close to a real-time view as we can get given that Treasury updates the statement daily. The current reading is at 3.4% real, which is towards the low range of the year. Perhaps most interesting is that the labor market appears to have peaked right around the announcement of the tariffs in April. As a side note, I like to use the 14 week smoothed data with the CPI adjustment, but it can be useful to look at the data in different ways.

Anyhow, it’s all about to get a lot more interesting around here. We’ll be getting regular economic updates and there are a lot of conflicting signals at present so hopefully we start to find some direction in the coming weeks.

2) Asset Diversification isn’t Temporal Diversification.

Good asset-liability matching is all about temporal diversification. For instance, if you were fully invested in a 60/40 stock/bond fund in 2008 and it falls 30% from the highs then you might have found yourself seeking liquidity. But you didn’t have liquidity because, in order to access the cash that’s inside your 40% bond slice, you needed to redeem both the stocks and the bonds. In other words, you were diversified across assets, but your portfolio wasn’t diversified across time horizons.

This has been one of the more enjoyable things to build in my forthcoming HourglassFP tool, which I’ll be releasing in the next few weeks. It is (the first ever?) asset-liability matching tool that can be used for personal financial planning needs. And one of the outputs from it is your temporal diversification. As an actual example of this, here’s a generic old-school pie chart showing an investor’s 60/40 portfolio. It’s interesting in that it shows you your distribution of assets.

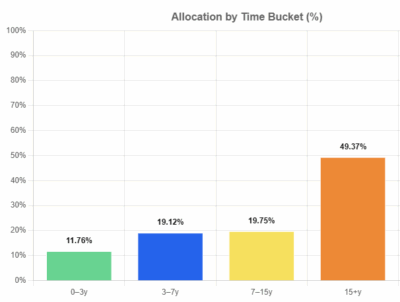

But it’s essentially showing you what I described above. Where Hourglass gets granular is in the way it will breakdown your exact temporal allocation. For instance, here’s a 60/40 constructed in Hourglass except the tool breaks down your asset allocation by the 4 primary temporal zones I like to use. Here’s what the output looks like:

The old school pie chart doesn’t really help you understand your different time horizons because it’s too general in nature. Hourglass, on the other hand, will breakdown the 4 primary time horizons AND show you an even more granular set of allocations across the time horizons WITHIN each bucket. In doing so it is communicating a very clear set of assets aligned to specific needs across time. And perhaps more importantly, it’s communicating how your sequence of returns risk exists across time by specific instrument. That is, after all, the problem with the aforementioned example. You might have asset diversification by holding a single 60/40 fund, but you might also have increased sequence of returns risk in that instrument because you didn’t disaggregate its components into the time zones that make its diversification so beneficial in the first place. Hourglass shows you your asset allocation not only by asset class, but by time horizon thereby helping you understand the probability of having liquidity across different time horizons.

Stay tuned in the coming weeks. I am releasing HourglassFP Basic for retail investors and a PRO version is in beta testing for advisors already. If you want to access it please reach out.

3) How to Start an ETF (and much more).

I did a fun interview with Ben Carlson from Ritholtz Wealth. We covered a lot of ground including:

- My origin story and how I transformed from a stock picker to an indexer.

- How the GFC impacted my view on time horizons and how working with banks got me started with asset-liability matching strategies.

- What is Defined Duration Investing and why I believe ALM strategies are the future of asset management.

- How to start an ETF and why we’ve been creating more.

I hope you find this one informational.

I’ll probably be back Thursday or Friday after the data dump so until then, have a great week.